Global markets witnessed a renewed surge in gold prices as the US stock market hit all-time highs following the Federal Reserve’s recent interest rate cut. While investors welcomed the Fed’s move, Federal Reserve Chair Jerome Powell highlighted ongoing economic challenges, including persistent inflation risks and employment concerns.

These factors have collectively contributed to increased demand for safe-haven assets like gold, signaling a complex yet promising environment for gold prices in the near term.

Powell’s Inflation Warning Clouds Market Optimism but Supports Gold Prices

After the Fed’s decision to lower interest rates on Wednesday, Powell described the current economic landscape as “a challenging situation,” stating that “in the near term, risks to inflation are tilted to the upside and risks to employment to the downside.”

This signals that while the Fed expects overall inflation to ease next year, pressures could persist due to tariffs and other external factors.

Powell explained, “What’s happening here is services inflation coming down, and that’s offset by increases in goods, and that goods inflation is entirely in sectors where there are tariffs.” The lingering impact of President Donald Trump’s tariffs is therefore expected to keep price pressures elevated, supporting continued strength in gold prices as investors hedge against inflation uncertainty.

This economic backdrop plays a critical role in sustaining demand for gold, as investors look beyond stock market gains to safeguard their portfolios against inflation and geopolitical risks.

Technical and Fundamental Drivers Fuel Gold Prices Breakout

From a technical perspective, gold prices recently broke out of a long term symmetrical triangle pattern on the XAU/USD 4 hour chart, signaling the continuation of an upward trend. The breakout pushed prices above $4,270, with analysts projecting a potential rise to nearly $4,720, an increase of over 11%.

Key technical indicators support this momentum, the Relative Strength Index (RSI) remains bullish at 65, showing that gold is not yet overbought, and the Moving Average Convergence Divergence (MACD) line recently crossed into bullish territory with expanding momentum.

Support levels to watch include $4,180 and $3,998, remnants of previous corrections. Staying above these levels is critical for bulls to maintain control and push gold prices higher.

These technical signals coincide with broader macroeconomic factors. Inflation expectations remain high amid geopolitical tensions and persistent uncertainty in global markets. Central banks continue to bolster gold reserves, further underlining the metal’s role as a hedge against risk.

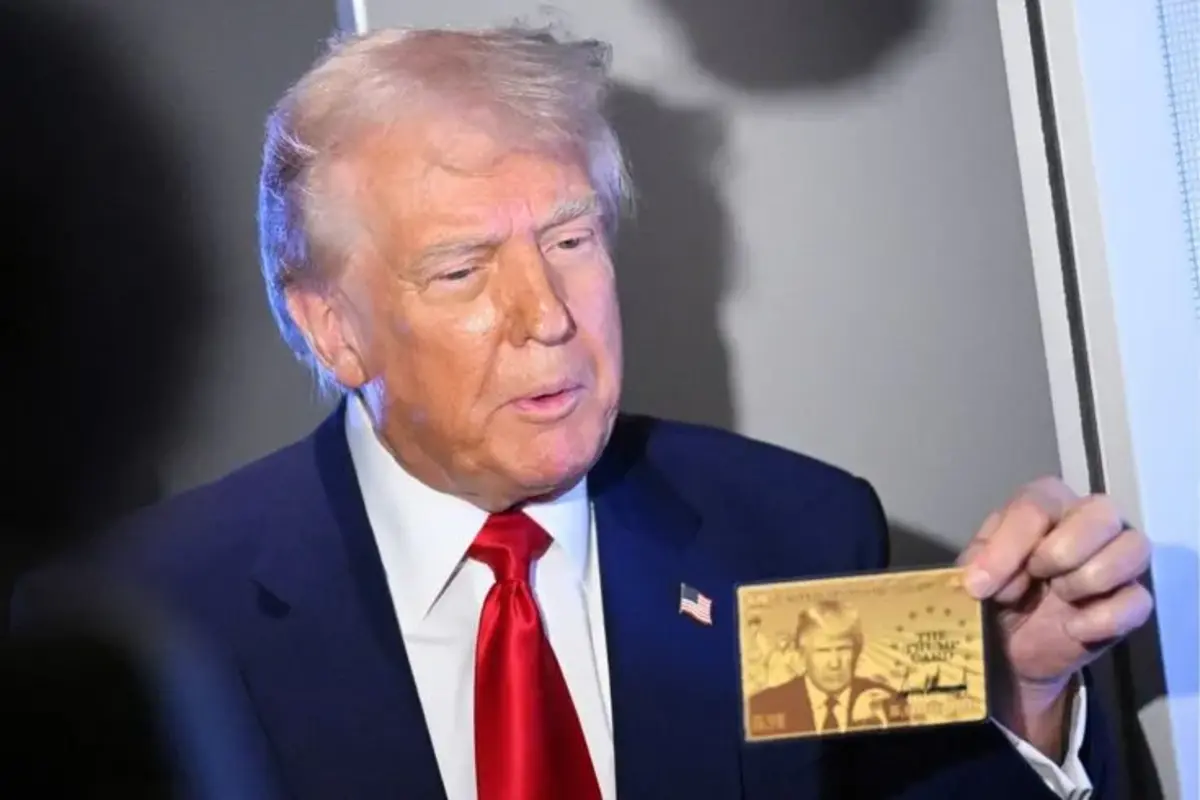

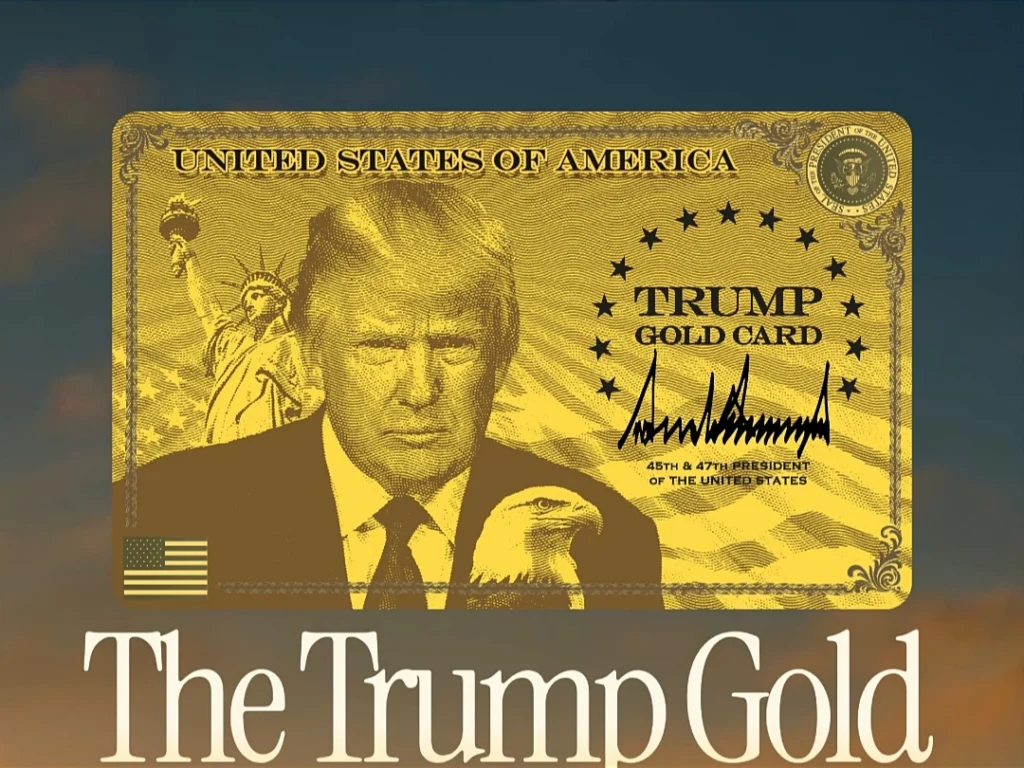

Can Trump’s Gold Card Visa Solve the US Employment Crisis?

In an effort to address a long-standing employment crisis in the United States, President Donald Trump launched the much-anticipated Gold Card visa program, priced at $1 million, allowing major companies to fast-track work permits for highly skilled foreign talent.

This policy aims to alleviate hiring difficulties faced by American firms and maintain the competitiveness of the US economy.

The US has been facing a persistent employment challenge, with many companies struggling to find qualified talent to fill key positions. In response, President Donald Trump introduced the Gold Card visa program, a high-cost, fast-track immigration system designed to attract top foreign professionals to the country more efficiently.

This program aims to ease the hiring difficulties by allowing companies to “buy” faster access to highly skilled workers, helping to fill critical gaps in the workforce. By speeding up the immigration process, the Gold Card visa intends to boost the competitiveness of American businesses and support economic growth.

However, while the program may alleviate some labor shortages in specialized sectors, it is not a comprehensive solution to the broader employment crisis. Factors like domestic workforce development, wage policies, and economic conditions also play crucial roles.

Additionally, the program’s high cost and exclusivity mean it primarily targets elite talent, potentially leaving many industries and regions still facing staffing challenges.

Also read: Gold Prices Rally as Markets Brace for Fed Policy Shift and Escalating Russia Threats

Silver and Bitcoin Also Reflect Growing Market Confidence

Alongside gold prices, silver and Bitcoin have shown significant gains, reflecting an overall improvement in risk sentiment. Silver recently broke out of a decades long cup and handle pattern, pushing past a key resistance level near $36. Despite technical signals indicating overbought conditions, momentum remains strong, with targets near $70 on the horizon.

Bitcoin, meanwhile, continues to attract investors as the broader market recovers, adding to the diversification of portfolios seeking a mix of traditional and digital safe havens.

With inflation risks skewed to the upside and employment concerns looming, the economic environment remains delicate. Investors eyeing gold prices should monitor key technical levels and Fed policy updates closely.

Powell’s cautious tone suggests that while rate cuts may provide temporary relief, longer-term inflationary pressures remain a significant concern, supporting gold’s status as a preferred asset during uncertain times.

In the coming weeks, the markets will also digest the impact of tariffs on goods inflation and watch for signals from central banks globally regarding monetary policy shifts.