Gold price today surge in silver trading volume across global exchanges, coupled with a crucial week of central bank decisions, has investors asking: is this rally merely a temporary rebound, or the beginning of a new phase of gold’s strength?

Gold price today increase is not isolated. Gold rebounded in London trading after erasing last weekend’s correction and is back nearing its all-time high. However, the main catalyst actually came from silver.

The surge in silver trading volume on the US Comex, followed by a sharp increase on the Shanghai Futures Exchange, created a ripple effect throughout the precious metals market.

“Last Friday’s gold rally was inextricably linked to the extreme surge in silver volume,” said Bruce Ikemizu, Chief Director of the Japan Bullion Market Association. “When silver moves aggressively, it often receives a psychological boost and liquidity.” explain more Ikemizu.

Gold Price Today Resilient Amid Uncertainty

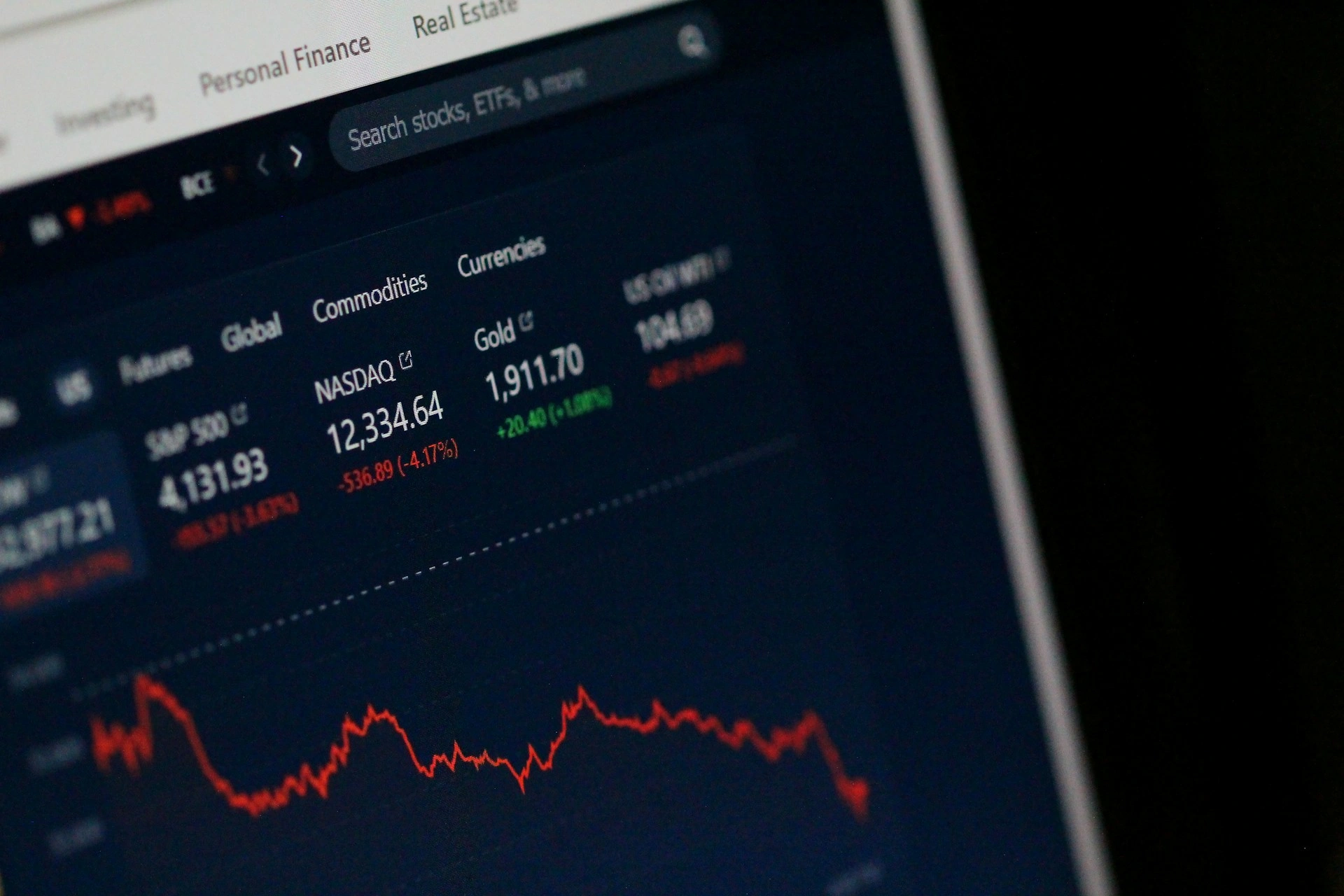

Technically, gold price today shows strong resilience. The London gold price managed to recoup a 1.2% decline from the previous session and recorded its fifth consecutive weekly increase a rare consistency.

This confirms gold’s role as a hedge against stock market volatility and uncertainty over the direction of global monetary policy.

“Gold is currently traded not only as a safe haven, but also as a response to cross-border monetary policy uncertainty,” wrote the Saxo Bank strategy team.

Wants more updated information about gold price? please check it out only on here Gold Price Today – Price in UK!

The Role of Silver as a Industry and Market Perception

Around 60% of silver’s annual demand comes from the industrial sector, making it highly sensitive to economic growth expectations. This factor strengthens the gold price narrative today.

Silver managed to recover and re-enter the USD 64 per ounce area in London, approaching last week’s peak. This indicates that physical and speculative demand are still coexisting.

“Silver is supported by hard asset demand and tight supply,” wrote the Saxo Bank Strategy Team, “creating a price foundation that supports the entire precious metals sector.”

Also read: Gold Prices Extend Rally on Fed Easing Despite Volatility Warning – Price in UK

ETFs Enter while Asia Resists

Today’s strengthening gold price was also supported by inflows into gold ETFs. The SPDR Gold Trust and iShares Gold ETF recorded net inflows, indicating a resurgence in institutional investor interest.

“An influx of funds into ETFs typically signals a more sustained rally,” said a London-based precious metals analyst.

In Asia, gold traded slightly below its record on the Shanghai Gold Exchange, indicating consolidation, not a massive distribution.

Global Economic Factors Influencing Precious Metals

1. Global Central Bank Interest Rate Policies

Interest rate cuts and signals of monetary easing have depressed real yields, increasing gold’s appeal as a hedge and supporting today’s gold price.

2. US Dollar Movement

A weakening dollar makes gold more affordable for global investors, while the resilience of gold price today despite a stable dollar indicates strong structural demand.

3. Geopolitical Risk and Political Uncertainty

Regional conflicts, global trade fragmentation, and political tensions increase safe-haven demand, strengthening the positions of gold and silver.

With gold prices remaining strong today amidst a surge in silver and the global central bank agenda, this momentum deserves serious attention. For investors seeking a hedge or strategic opportunity in precious metals, now is the time to review positions and read market signals before the next round of volatility arrives.

Get the latest and interesting news only at Price in UK!