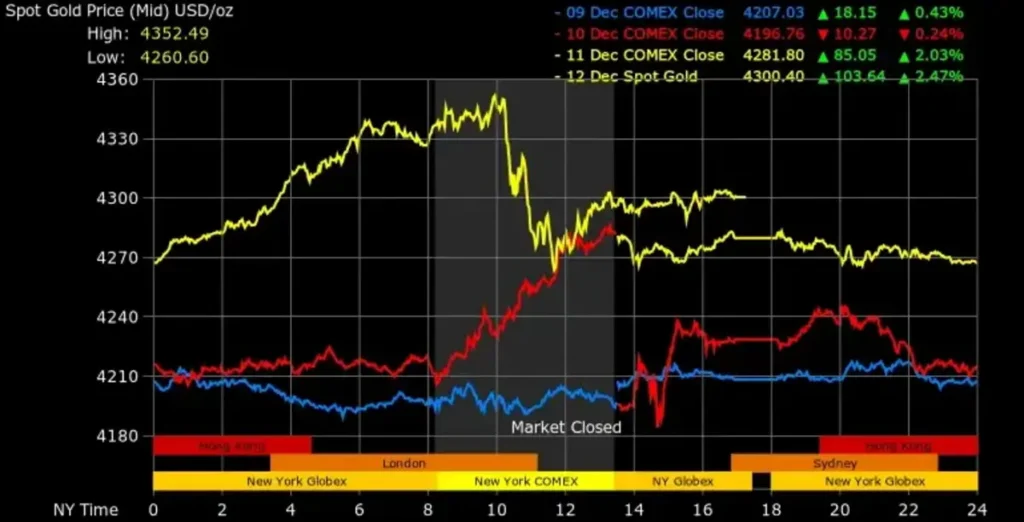

Gold price today remain stable near their highest levels after a sharp rally throughout 2025. Although gold prices appear to have stalled in the USD 4,200–4,300 per troy ounce range in recent weeks, Bank of America believes this phase does not signal a peak, but rather a healthy pause before potential further gains.

Throughout this year, gold has recorded an extraordinary performance. From an initial position of around USD 2,630 per ounce, the gold price today is now around USD 4,280, representing an increase of more than 60% year-to-date. This achievement marks one of gold’s strongest rallies since the late 1970s.

Gold Price Today is Expensive in Price But Cheap in Portfolio

However, Bank of America analysts emphasized that the recent slowdown in price movement does not signal a weakening trend. Bank of America’s chief metals analyst, Michael Widmer, stated that gold rallies typically end not because prices become too high, but when the driving factors for demand begin to fade.

Gold prices may appear overbought, but ownership is actually still underinvested,” Widmer stated in his annual outlook presentation

He noted that although gold price today has surged sharply, gold still occupies a very small portion of large investors’ portfolios. Among high-net-worth investors, gold accounts for an average of only about 0.5% of the total portfolio, far below its ideal role as a diversified asset.

Wants more updated information about gold price? please check it out only on here Gold Price Today – Price in UK!

This imbalance is considered to hold potential for further upside. Widmer estimates that an increase in investment demand of just around 14% would be enough to push gold prices towards USD 5,000 per ounce. This figure is in line with the recent surge in investment interest.

On the other hand, gold price today also reflects changes in how investors construct portfolios. Economic uncertainty, lower interest rates, and growing doubts about the classic 60/40 stock-bond strategy have led to gold being re-emerged as a primary hedge.

Macroeconomic conditions remain strongly supportive. Declining real yields, a weakening US dollar, aggressive central bank buying, and a surge in capital flows into gold ETFs have strengthened gold’s position as a global hedge.

Looking ahead, several major Wall Street banks project an average gold price of USD 4,500–5,000 per ounce in 2026, with the potential for higher prices if investor allocation shifts materialize.

Get the latest and interesting news only at Price in UK!