As the gold price today continues to reach new heights, the impact is not only felt in the global commodity market but also flows directly into the coffers of Indonesian mining tycoons. The surge in gold prices has now become a driving force for capital creation, business expansion, and increased wealth valuations.

The rise in gold prices throughout this year has opened up strategic opportunities for Indonesian gold entrepreneurs. They are not only enjoying the rising asset value, but also converting the price momentum into concrete corporate actions from IPOs to cross-border acquisitions.

Garibaldi Thohir and Edwin Soeryadjaya are prominent examples. Both capitalized on the gold rally by taking Merdeka Gold Resources shares public, raising trillions of rupiah through the IPO in September. The Pani gold mine in Sulawesi, with reserves of nearly 5 million ounces, is a major magnet for investors.

Gold Price Today and the Ripple Wealth Effect

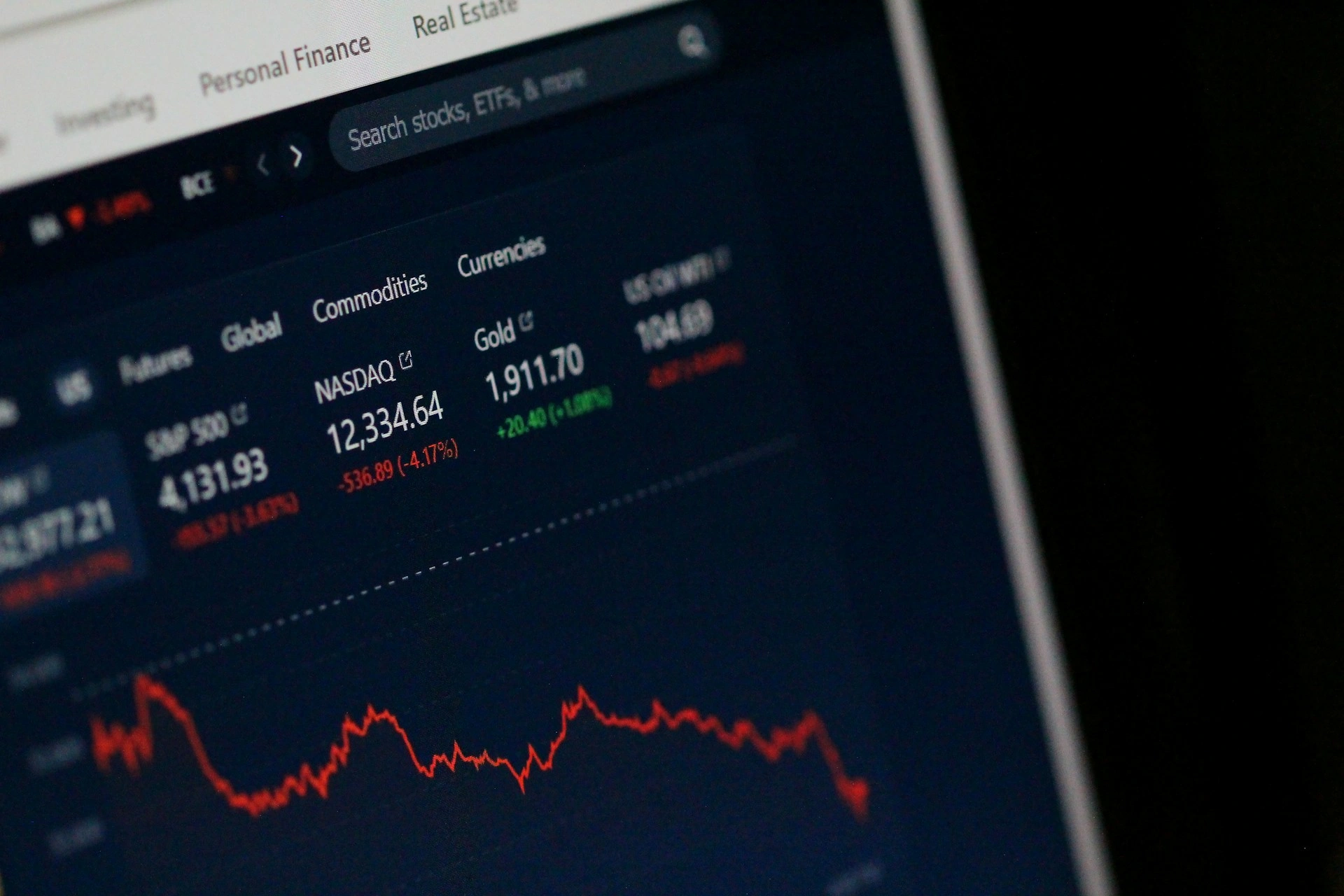

Gold price today rally creates a domino effect on the stock valuations of mining companies. When gold prices surge, underground reserves automatically become more valuable, and the stock market reacts quickly.

Shares in Archi Indonesia one of the nation’s largest gold producers soared more than fourfold in a year. This surge boosted the wealth of its controlling shareholder, Peter Sondakh, by approximately US$1 billion. For investors, this demonstrates that the market values not only current production but also the long-term potential of gold reserves.

Wants more updated information about gold price? please check it out only on here Gold Price Today – Price in UK!

Conglomerate Diversification in an Era of Expensive Gold

Interestingly, Gold price today rally is also accelerating the business diversification of Indonesian conglomerates. Peter Sondakh, through Rajawali Corpora, combines a mining portfolio with premium hotel and media assets. This strategy makes his wealth more resilient to economic cycles.

On the other hand, Garibaldi Thohir and Edwin Soeryadjaya also have substantial exposure to the coal sector, demonstrating how gold is now a strategic complement to a natural resource portfolio.

Acquisition and Expansion Gold as Fuel

Rising of gold price today not only fueled IPOs but also triggered acquisition activity. Bumi Resources, through its gold and copper subsidiary, acquired an Australian gold mining company. This move was immediately welcomed by the market, with Bumi Resources shares surging significantly.

For investors like Anthoni Salim and Agoes Projosasmito, gold is now a new source of growth beyond the traditional coal business. This confirms that gold is no longer just a defensive asset, but also an instrument for expansion.

Global Markets Strengthen the Narrative

Globally, gold price today has risen more than 60% since the beginning of the year and is projected to continue. Bullish projections from international investment banks reinforce the belief that this rally is not over.

This condition has helped push the total wealth of Indonesia’s 50 richest people to a new record, as the domestic stock index has strengthened. Gold has been a key driver behind this surge.

Also read: Gold Prices and Silver Prices Fall Back After Record Run, Volatility Persists – Price in UK

What Does It Mean for Investors and the Market?

The stories of these mining billionaires demonstrate that gold price today is more than just numbers on the trading screen. High gold prices are transforming business strategies, increasing access to funding, and increasing the attractiveness of the mining sector to global investors.

For the capital market, gold now serves as a bridge between commodities and equities connecting global spot prices with domestic stock valuations.

With gold prices still trending upward today and corporate actions continuing, investors have two options that is simply observe or capitalize on the momentum. If you’re looking for opportunities in the mining sector, the stock market, or diversifying gold-based assets, now is the perfect time to review your strategy before the next price cycle takes a turn for the worse.

Get the latest and interesting news only at Price in UK!