Cathie Wood’s latest insight has once again shaken the old narrative about gold and Bitcoin on Friday (5/12/25). With the US economy still haunted by sub-floating inflation, she emphasizes that investors need to re-examine the dynamics of gold price today, productivity, and the direction of monetary policy to understand the major trends at play.

Inflation Remains High, But Wood Sees a Different Direction

Although US inflation remains stable in the 2.5–3% range, Wood believes this trend does not automatically lead to new interest rate hikes. She believes that growth driven by AI, automation, robotics, and blockchain technology is the main factor driving down production costs.

She asserts, “Many people think growth means inflation. That’s wrong. For 45 years, when productivity-based growth rose, inflation actually fell.”

This insight is important because inflationary pressures are typically the driving force behind gold prices today, while productivity in the technology era has the potential to reverse this trend.

Gold Price Today vs Bitcoin: Who’s Stronger?

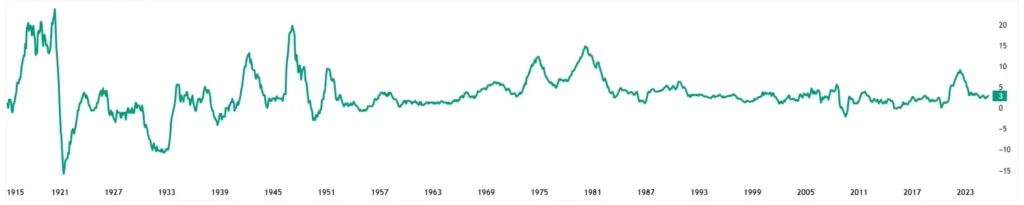

In the classic Bitcoin vs gold debate that has resurfaced, Wood stated that many investors are still waiting for a “delayed” wave of inflation due to the surge in liquidity during the COVID era. However, she believes historical data suggests that gold could fall sharply when the market shifts its focus to growth. She cited the example of gold’s collapse in the early 1980s, when the then-current gold price plummeted 67% in five years. She said, “The dollar is getting stronger. The dollar is better than gold.“

By examining trends in the gold-to-money supply (M2) ratio, she predicts a similar scenario could repeat itself, especially if current economic policies are like “Reaganomics on steroids.”

On the other hand, she believes increased global liquidity and long-term deflationary concerns will give Bitcoin an edge over gold.

Wants more updated information about gold price? please check it out only on here Gold Price Today – Price in UK!

The Fed’s Policy and Its Impact on Gold Price Today

Wood projects an 80–90% chance that the Fed will soon cut interest rates. If that happens, two things could potentially intersect:

- liquidity increases

- demand for risk-on assets increases

- pressure on today’s gold price could reverse direction again

In other words, the gold and crypto markets are at a major inflection point.

If you’ve been following gold price today movements, this article reminds you that:

- Technological productivity could suppress inflation

- Fed policy could change the direction of gold prices

- Bitcoin is projected to be a long-term outperformer

Gold price today movements can no longer be interpreted solely through inflation or the direction of the dollar, as in previous eras. Cathie Wood’s insights show that we are in a major transition: when technological productivity begins to replace inflation as the primary driver of the economy. This means that the old pattern “inflation rises, gold rises” is no longer absolute.

Savvy investors must begin to read the market not just from today’s gold price, but from structural changes technology, monetary policy, and new demand patterns. It’s not about choosing gold or Bitcoin, but understanding when each asset is at its peak potential. Gold or bitcoin, which do you think has more potential if it is made into an asset?

Get the latest and interesting news only at Price in UK!