Bitcoin price today is still a big concern for traders and investors in the extremely dynamic cryptocurrency industry. The Moving Average (MA), a straightforward yet effective technical indicator that aids in understanding market trends and momentum, is one of the most popular tools for examining Bitcoin price today movement. This article will give you knowledge about what exactly Moving Averages that sometime trader ask. Scroll down till the end!

In The Context of The Current Price of Bitcoin, What is a Moving Average?

An indicator called a Moving Average (MA) determines the average price of Bitcoin over a given time period in order to show a smoother trend that is unaffected by abrupt short-term swings. This is quite helpful for evaluating the current direction of the price of Bitcoin objectively, particularly in times of volatility. In general, there are two types of MAs that are often used:

- Exponential Moving Average (EMA) is statistics that gives more weight to recent prices, making it more responsive to changes in bitcoin price today.

- Simple Moving Average (SMA) is statistics show a simple average of closing prices over a period of X.

How Traders Can Understand Bitcoin Price Today Direction using Moving Averages

1. Recognizing Trends

The market is often positive when the price of Bitcoin stays above a long-term moving average, such as the 200-day moving average. On the other hand, emotion may become pessimistic if it drops below it.

2. Signals of Crossover

- Golden Cross is sign a possible increase in the current price of Bitcoin is indicated when the short-term moving average rises above the long-term moving average.

- Death Cross this is sign the opposite of above, it could indicate bearish pressure.

3. Dynamic Support and Resistance

Moving averages can also function as dynamic support or resistance levels, providing insight into where today’s Bitcoin price might rebound or stall.

Wants more updated information about bitcoin price today? please check it out only on BTC Price Today – Price in UK!

An Actual Bitcoin Price Analysis Example

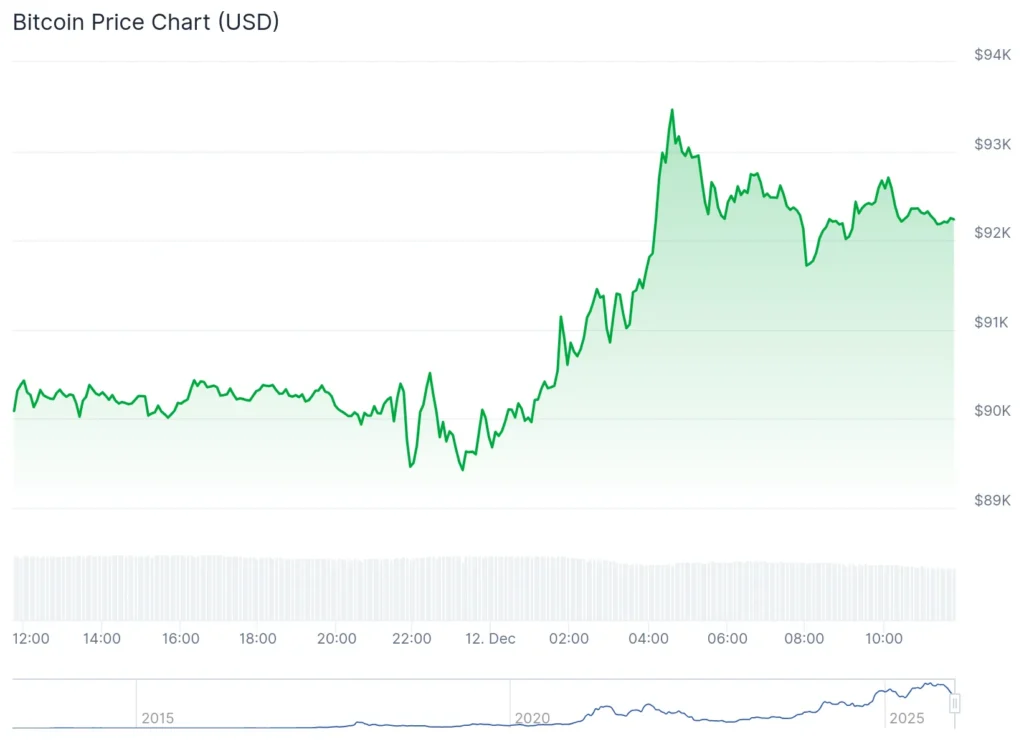

The 50-day and 200-day moving averages on current Bitcoin price charts are frequently used by traders to search for trend indicators during erratic times. Many observers consider the moment when the price of Bitcoin crosses the 200-day moving average to be crucial in assessing the strength of the long-term trend. Because the moving average (MA) is based on the average of past closing prices, every change in the price of Bitcoin today will have an impact on the MA line’s direction, giving a more accurate picture of market momentum.

Advantages & Limitations of Moving Averages for Bitcoin Price Today Traders

- Using MA as indicator, investor know how to reduces daily price noise and highlights larger trends.

- MA also can provides easy-to-understand signals for entry or exit using Bitcoin price today. Because the MA is based on historical data, it is a lagging indicator meaning it only confirms existing trends, not predicts price changes with certainty.

In reality, no indicator is perfect. However, using a Moving Average in conjunction with other indicators such as the RSI or MACD can increase the accuracy of Bitcoin price today signals.

Also read: Bitcoin Prices Under Pressure from Fed’s Cautious Stance and AI Profit Issues – Price in UK

As the crypto market continues to evolve, understanding technical tools like moving averages is becoming a fundamental skill every trader should possess. By combining historical trends and actual prices, moving averages help unravel market complexity and provide a stronger foundation for making trading decisions when viewing Bitcoin price today. That’s all knowledge about moving average in bitcoin element who research by editorial team Price in UK. You already know right?