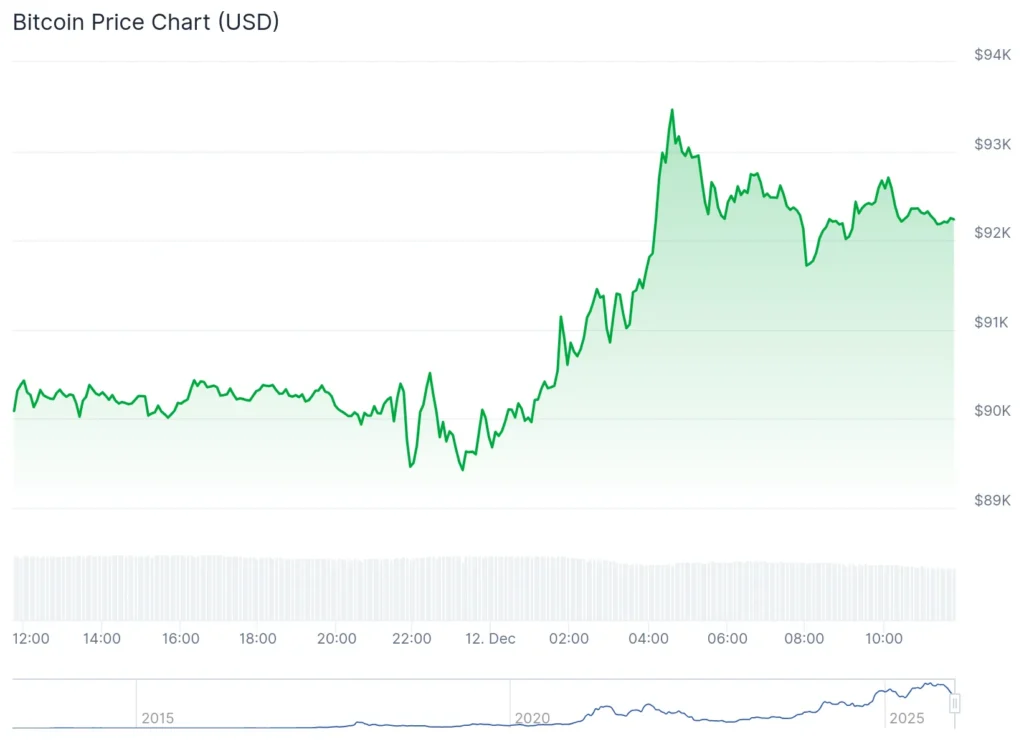

Bitcoin price today came under heavy pressure again after the Federal Reserve’s decision to cut its benchmark interest rate by 25 basis points was not followed by any signs of further easing. Despite briefly surging above $94,000, the bitcoin price today reversed sharply and touched $89,730, before stabilizing slightly at around $92,451, 2.4% increase over the past 24 hours.

Analysts believe this market reaction was a response to Fed Chairman Jerome Powell’s hawkish tone, which emphasized that the projected interest rate cuts in 2026 would be much more limited.

The Fed Surprises Market, Bitcoin Price Today Takes a Hit

The interest rate decision was actually anticipated by the market, but the 9-3 vote in the FOMC shook investor confidence. Two officials opposed a rate cut, while one called for a larger cut. Powell’s cautious stance weakened risk assets, including crypto. Bitfinex analysts said this hawkish tone

Hampered speculative interest and triggered a reversal in the Bitcoin price today

The Fed’s interest rate hikes often have an impact on global markets, particularly in Asia. This occurs due to capital outflows from developing countries to the United States. Investors are more attracted to dollar assets due to their higher yields and perceived safety. This can lead to a weakening of the exchange rates of developing countries’ currencies, including Indonesia, and increase volatility in the capital markets.

Lack of New Buyers, ETFs Become Directional Indicators

Standard Chartered stated that the crypto market is currently facing a shortage of institutional buyers. Geoff Kendrick, global head of digital asset research, emphasized that the greatest burden now rests on Bitcoin ETFs to maintain stable capital flows. He called Vanguard’s move to open access to crypto ETFs a positive signal, but predicted that the Bitcoin price today would rise.

More slowly than in previous cycles

Tech Stocks Fall, Macro Sentiment Weakens

The weakening Bitcoin price today was also triggered by global pressures. Technology stocks fell after Oracle reported disappointing earnings and AI prospects, sending its shares plummeting 11%. Asian markets and US futures moved negative, while the Fed’s projection of only one interest rate cut in 2026 worsened short-term sentiment.

Wants more updated information about bitcoin price today? please check it out only on BTC Price Today – Price in UK!

Institutions Are Moving Smart Money Remains Bullish

Despite the market weakness, large purchases continue to occur:

- MicroStrategy adds over 10,000 BTC

- Bitmine Immersion Technologies (BMNR) buys 138,452 ETH

- Twenty One Capital (XXI), a company associated with Tether, officially goes public

These steps demonstrate that today’s decline in Bitcoin’s price hasn’t stopped institutions from investing.

Target Revised, Optimism Remains High

Although the target had to be revised, Standard Chartered had to lower its target to:

- End of 2025: $100,000

- 2026: $150,000

Bernstein also forecasts a new, longer Bitcoin cycle:

- 2026: $150,000

- 2027 Peak: $200,000

- 2033: ± $1 million

JPMorgan assesses that Bitcoin price today has the potential to reach $170,000 in 6–12 months, as institutional interest and gold-based volatility models increase.

Bitcoin price today movement reflects a market searching for direction. Macroeconomic pressures are holding back momentum, but institutional interest is a strong support for the long-term trend. What do you think investors should do next?

Get the latest and interesting news only at Price in UK!