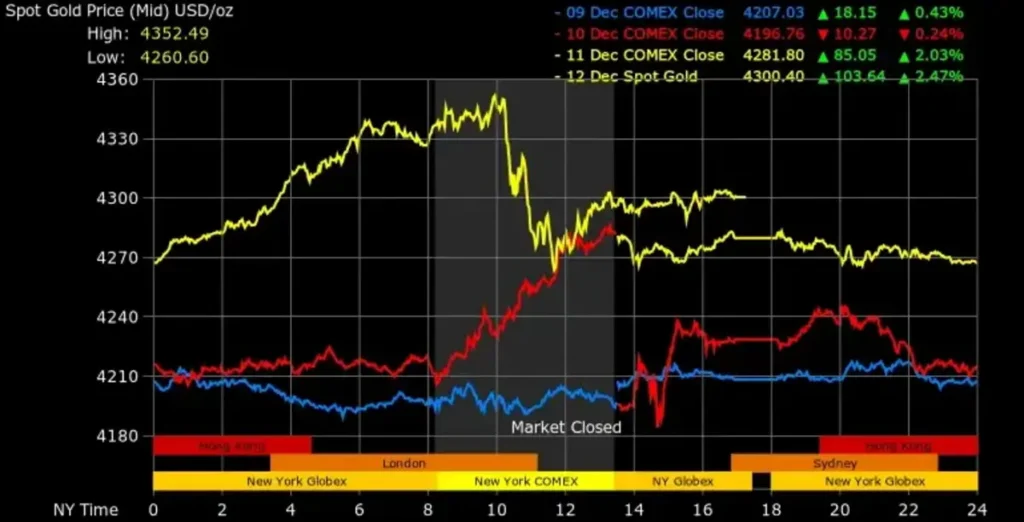

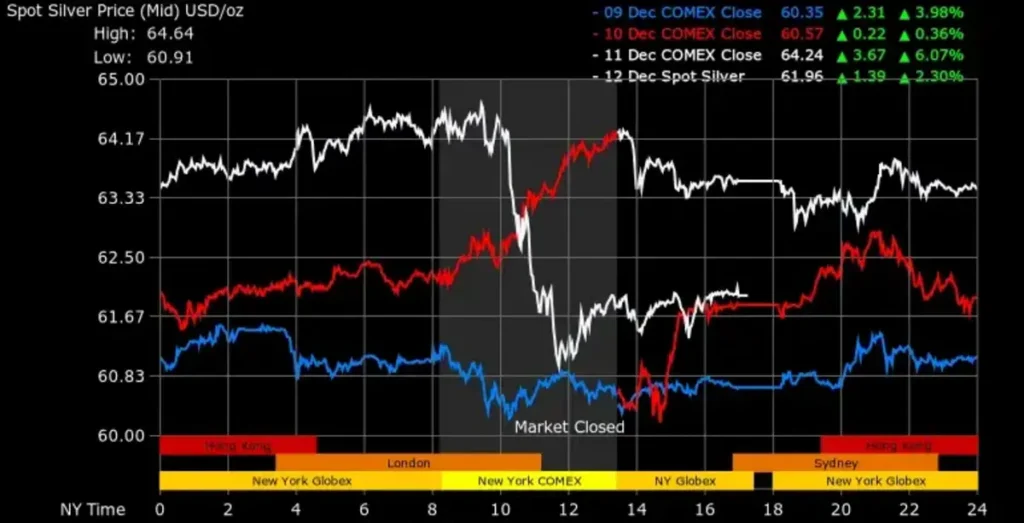

Gold price today movements are capturing the attention of global market players. Over the last three trading days, gold and silver prices have shown a solid upward trend, reflecting market reactions to the Federal Reserve’s (Fed) interest rate cut. Graph data shows a surge in prices coinciding with the weakening of the US dollar and falling US government bond yields.

On Thursday local time, gold recorded a sharp increase after the Fed cut interest rates by 25 basis points, pushing the dollar lower and increasing the appeal of precious metals.

Gold Price Today Strengthen, Investors Return to Safe Haven

Based on market data, spot gold rose 1.2% to USD 4,280.08 per troy ounce, marking its highest position in more than a month. Meanwhile, US gold futures contracts for February delivery closed up 2.1% at USD 4,313 per ounce.

Technically, gold price today touched a high of around USD 4,352 per troy ounce before stabilizing above the USD 4,300 level. This strengthening marks a three-day rally, reflecting increased investor interest in gold as a hedge asset.

Marex analyst Edward Meir believes that lower interest rates amid inflationary pressures are a very positive combination for gold.

Inflation hasn’t really come back down to the Fed’s 2% target, so when you’re lowering rates in an inflationary environment, that’s very bullish for gold.

Silver Joins the Rally, Sets New Record

Not only gold, but silver prices also recorded a significant surge. Spot silver jumped nearly 4% to USD 64.22 per ounce, approaching its all-time high of USD 64.31 reached earlier in the same trading session.

This aggressive rise in silver also reinforced positive sentiment in the precious metals market.

Silver seems to be pulling gold up with it and it’s also pulling up platinum and palladium. There’s a lot of momentum behind it right now.

The silver rally is often a sign of increasing market optimism, where investors are not only seeking protection but also taking advantage of speculative momentum.

Wants more updated information about gold price? please check it out only on here Gold Price Today – Price in UK!

Dollar Weakens, Direct Impact of Fed Rate Cut

The Fed’s interest rate cut pushed the US dollar to its lowest level in eight weeks against a basket of major currencies. The weakening dollar made gold, which is priced in greenbacks, more affordable for global buyers, thereby strengthening demand.

The Fed announced its third consecutive interest rate cut on Wednesday, although policymakers also signaled a possible pause in further rate cuts while monitoring labor market conditions and relatively high inflation.

Lower interest rates generally benefit gold, as this precious metal does not provide a yield, making the opportunity cost of owning it smaller.

US Politics and Global Demand

On the political front, US President Donald Trump has been pushing for low interest rates since the beginning of his second term. The next Fed chair is expected to maintain a similar approach, with White House economic adviser Kevin Hassett cited as the strongest candidate.

From Asia, positive sentiment also comes from India. Indian pension fund regulators have officially allowed investment in gold and silver ETFs, opening up the potential for new funds to flow into the precious metals market.

Also read: Gold Price Today: USD, GBP, INR See Gains Amid Fed Cut, What Investors Need to Know?

Can Gold Price Today Continue to Rise?

Going forward, the movement of gold price today will be greatly influenced by the release of US non-farm payrolls data on December 16, which will be an important indicator of the Fed’s next policy direction. As long as interest rates remain low and inflation is not fully under control, gold has the opportunity to maintain its positive trend, even though short-term volatility still looms over the market. Do you think the price of gold and silver will continue to rise after the Fed’s decision to cut interest rates?

Get the latest and interesting news only at Price in UK!