The current price of Bitcoin has remained steady, hovering close to US$90,342. This stability shows that investors are cautious and are observing the situation as they consider the possibility of the Federal Reserve lowering interest rates. At the same time, there is growing examination of how Bitcoin treasury firms affect worldwide finance.

According to the one-month chart, Bitcoin is currently in a period of stability after significant ups and downs from late November to early December. The total market value is approximately US$1.8 trillion, and the daily trading activity is about US$35.8 billion, showing that there is good liquidity, even though the overall mood is not completely positive regarding risk.

Market Awaits Changing Policy Triggers

Technically, Bitcoin has tested support in the US$88,000–US$89,000 area several times and managed to hold above the psychological level of US$90,000. However, resistance in the US$92,500–US$95,000 range still limits short-term upside potential.

This pattern indicates a balance between profit-taking and medium-term investor accumulation. In the context of Bitcoin price today, the market still needs a more decisive macro catalyst to emerge from its sideways phase.

Wants more updated information about bitcoin price today? please check it out only on BTC Price Today – Price in UK!

Liquidity is Key to Bitcoin Price Today Direction

The main narrative overshadowing the crypto market remains the direction of the Fed’s policy. Following the Fed’s 25bp rate cut decision last Wednesday, the Bitcoin market wavered and experienced a bullish turn. However, expectations of a Fed rate cut next year have the potential to support riskier assets, including Bitcoin, by improving liquidity and lowering opportunity costs.

However, the Fed continues to emphasize a data-driven approach. If inflation strengthens again or the US labor market remains solid, an interest rate cut could be delayed, a scenario that could potentially restrain the rise in Bitcoin price today in the short term.

Market Sentiment Regarding Bitcoin Movements Today

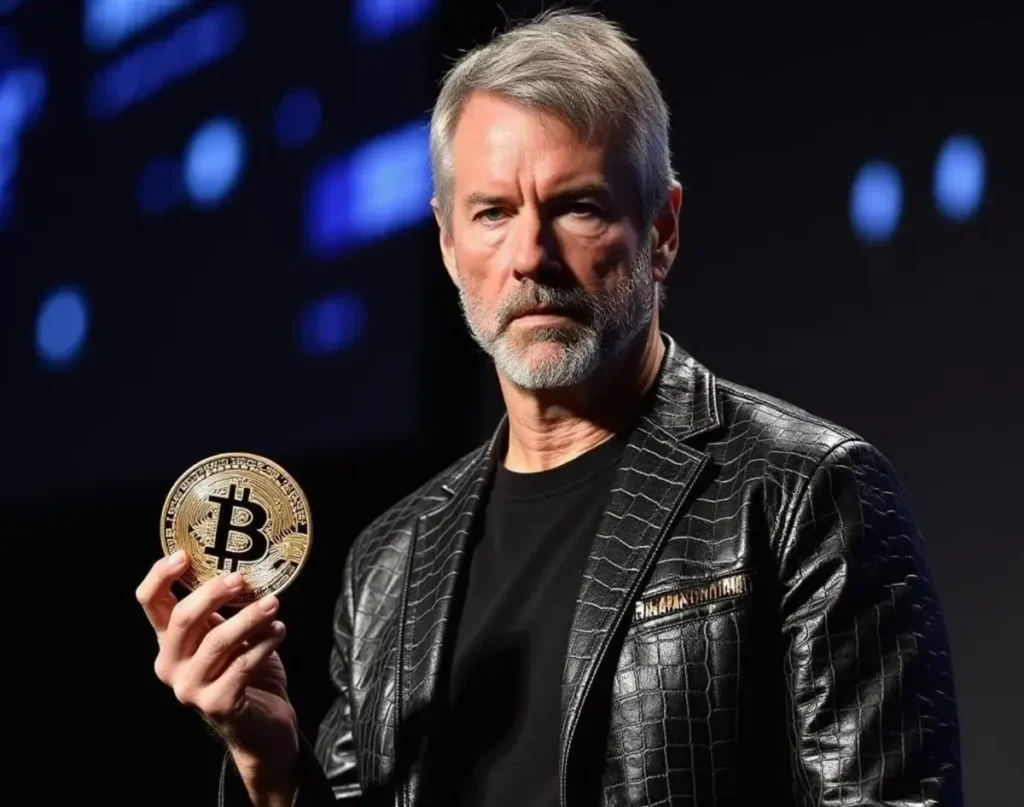

Institutional sentiment resurfaced on December 14th, when Michael Saylor retweeted a statement from Bitcoin treasury firm Strategy (DAT), which confirmed that the company would remain a Nasdaq 100 constituent. Saylor added a comment that immediately caught the market’s attention:

We’ll keep accumulating Bitcoin until the market stops whining

Previously, Strategy confirmed it would retain its status on the Nasdaq 100, an important signal for the legitimacy of a long-term Bitcoin accumulation-based business model. However, some observers believe this approach resembles an investment fund more than a traditional operating company.

This issue has become increasingly relevant as concerns about the sustainability of Bitcoin treasury companies have begun to grow. Global index provider MSCI reportedly has reservations about the presence of such companies in its index. MSCI is scheduled to make a decision in mid-January of next year regarding the possibility of removing Strategy and similar companies from its index.

Implications for Bitcoin Price Today

For the crypto market, this dynamic is two-sided. On the one hand, Saylor’s aggressive statements reinforce the narrative of long-term institutional accumulation, which serves as the psychological foundation for today’s Bitcoin price to remain at high levels.

On the other hand, if MSCI or other index providers seriously re-evaluate the presence of Bitcoin treasury companies, this could trigger additional volatility, particularly through institutional portfolio rebalancing and indirect regulatory pressure.

Bitcoin at The Intersection of Macro and Institutions

Going forward, the direction of Bitcoin price today will be determined by a combination of the Fed’s monetary policy, decisions by global indices like MSCI, and the sustainability of Strategy’s institutional accumulation model. As long as there is no clarity regarding the timing of the Fed’s rate cut and the regulator-index stance on Bitcoin treasury companies, the market is likely to remain rangebound.

This phase marks a significant shift, indicating that Bitcoin is no longer solely reacting to retail sentiment but is increasingly tied to the architecture of traditional financial markets.

Monitor signals from the Fed, MSCI’s January decision, and the movements of large institutions like Strategy. In this tense trade-off between liquidity and regulation, a disciplined approach, risk management, and a medium-term perspective are key to responding to Bitcoin price today movements. Are you agree with Saylor’s opinion?

Get the latest and interesting news only at Price in UK!