Bitcoin prices showed volatility again on December 8, slipping below $90,000 after a brief surge to $92,000. This price movement came despite the announcement that Michael Saylor’s company, MicroStrategy, had purchased an additional 10,624 bitcoins, a buy worth nearly $1 billion.

The mixed reactions from analysts and influencers reveal a divided outlook on the future of bitcoin prices, with some pointing to market manipulation and others warning of a bearish trend.

Bitcoin Prices Show Weak Response to Major MicroStrategy Purchase

Bitcoin prices initially jumped 4% early Monday to reach $92,000, fueled by the news of MicroStrategy’s significant bitcoin acquisition. However, this rally was short-lived, and prices soon dipped back to around $90,000 by the end of the day.

Historically, Michael Saylor’s announcements about MicroStrategy’s bitcoin purchases often gave the prices a boost, especially during the company’s aggressive, debt-funded buying spree earlier this year.

But as MicroStrategy scaled back on its leveraged purchases, the influence of these announcements on the prices has weakened. Analysts suggest that the market no longer reacts as strongly to such large purchases, especially when the broader macroeconomic environment is causing uncertainty in cryptocurrency markets.

The lackluster price action following MicroStrategy’s latest acquisition highlights the challenges bitcoin prices face amid fluctuating investor sentiment and growing concerns about a potential bear market.

Market Sentiment Remains Bearish Despite Bitcoin Prices Trying to Recover

The crypto market endured a major shock on October 10 when a sudden crash wiped out over $19 billion in leveraged positions within 24 hours. This event sent bitcoin prices tumbling to around $80,500, representing a decline of more than 30% from the October 6 peak of over $126,000.

Since hitting a low around November 21, the prices have been attempting a slow recovery, which has raised hopes that the digital currency might close 2025 with moderate gains. However, each upward rally in bitcoin prices has struggled to maintain momentum, often faltering within a few days.

MicroStrategy’s recent purchase, expected by many to inject fresh life into the market, failed to spark a sustained rally. Instead, bitcoin prices drifted downward shortly after the announcement, raising questions about the strength and resilience of the current recovery.

Analysts and Influencers Question the Impact of Large Bitcoin Purchases on The Prices

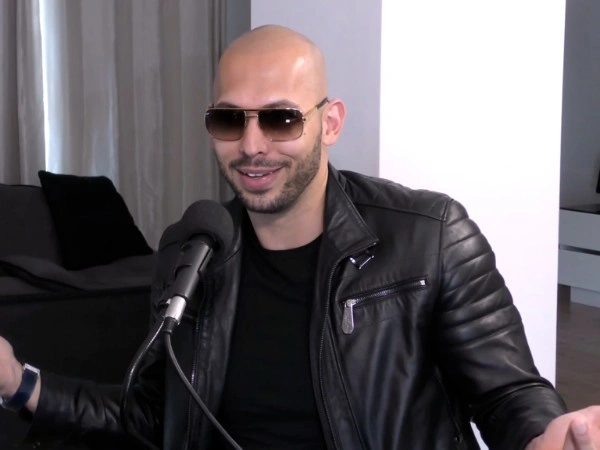

The disappointing reaction of bitcoin prices to MicroStrategy’s nearly $1 billion bitcoin purchase has sparked debates among analysts and cryptocurrency influencers. Andrew Tate, a well-known public figure in the crypto space, openly questioned why such a significant purchase failed to move the market.

“I’m huge on BTC, but MicroStrategy buying 10,000 BTC in one day and the price doesn’t move. Explain that to me,” Tate posted on social media platform X.

Some analysts have attributed the muted impact on bitcoin prices to alleged market manipulation by large traders. Jacob King, a financial analyst known for his contrarian views, argued that the crypto market is currently in the early stages of a bear market. He described Saylor’s recent purchase as a “staged pump,” designed to create short-term price blips for MicroStrategy to offload holdings at higher prices.

King further cautioned investors, reminding them that Saylor was once openly critical of bitcoin and that his recent aggressive buying might be a tactic to lure naive investors into chasing a falling asset.

“His latest buy was a staged pump, hoping the market blips enough so he can offload at a higher price. Saylor was once openly anti-BTC. His current ‘convert’ act is purely a trick to get naive investors chasing a sinking stock. Get out while you still can,” King said in a reply to Tate.

Also read: Amid Uncertain Bitcoin Prices, Strategy Makes Biggest BTC Buy in Months

What Lies Ahead for Bitcoin Prices?

Bitcoin prices remain under pressure as investors weigh conflicting signals. The inability of nearly $1 billion in fresh bitcoin purchases to reverse the downward momentum highlights the complex dynamics at play in today’s crypto markets.

While some market watchers remain optimistic about a future recovery, others are cautious, warning that bitcoin prices could face further declines if bearish market conditions persist.

For now, volatility is expected to remain a defining feature of bitcoin prices, with sharp swings continuing to challenge traders and investors alike.